Background

The finance industry has always had a fairly tech-forward mindset, and financial institutions have become more aware of the need to adapt to digital transformation. A growing number of retail banks and other financial organizations have begun using the technology to hedge the move to cloud solutions to implement new digital services and develop more customer-centric services.

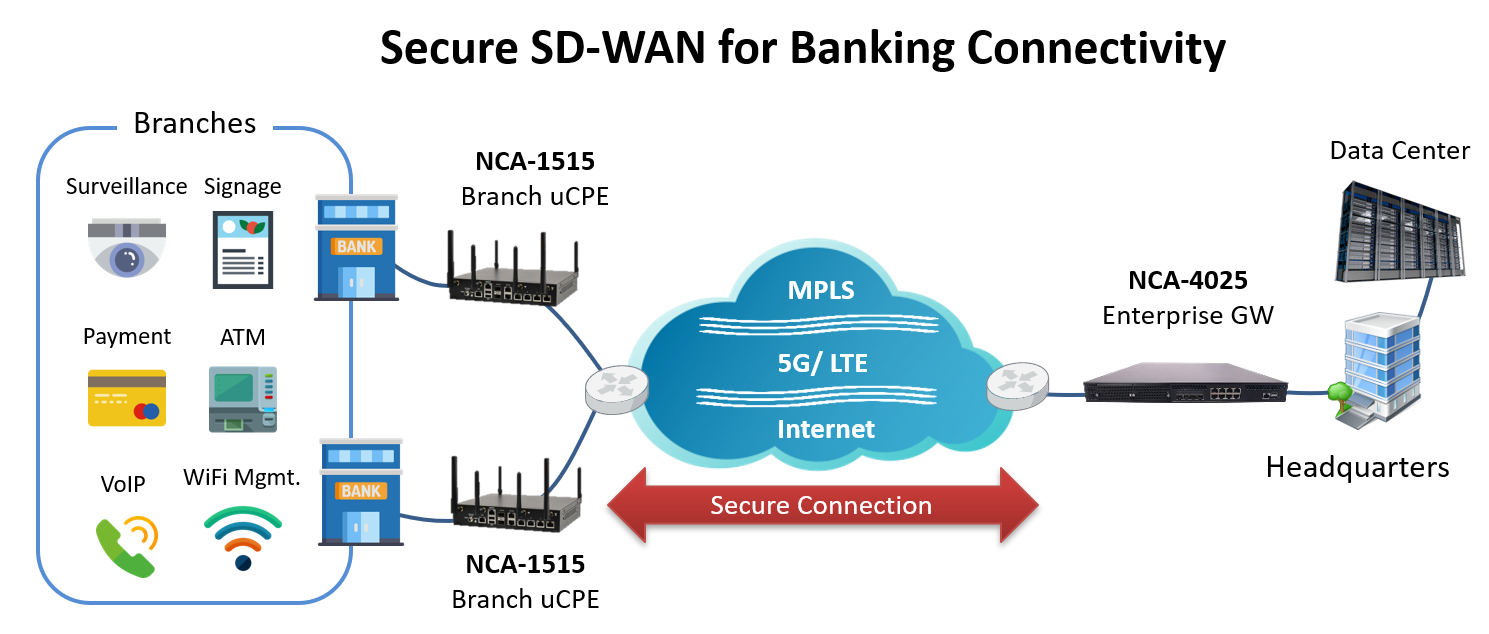

By adopting a software-defined WAN (SD-WAN) platform, financial institutions can simplify and secure their network infrastructure, improve agility and application visibility and reduce connectivity costs, while providing robust security in supporting digital/physical branch locations and private cloud.

A big advantage of SD-WAN is its ability to rapidly set up and seamlessly connect remote branch locations, ATMs, and cloud-based applications to a private network easily and securely. SD-WAN uses a centralized approach which gives organizations greater control over cloud solutions utilized across the enterprise. SD-WAN further enhances security by integrating VPN tunnels, and firewalls to segment the flow of network traffic.

Requirements

Additional benefit of SD-WAN is that it functions with any underlying network service such as MPLS, Broadband, or high-speed cellular networks such as 4G LTE and 5G. A US-based financial institution come to Lanner seeking a uCPE SD-WAN platform, and the jointly developed hardware solution needed to meet the following requirements:

● Software-defined Security

Banking SD-WAN needs to maintain a high level of security. It requires increased visibility, centralized security management, and onboard TPM for securing crypto-processing and tamper resistance at the hardware level, further minimizing security risk across the board.

● Multi-WAN Support

The device must be able to support a variety of communications options to seamlessly integrate public and private transport and intelligently route traffic to effectively utilize bandwidth, including MPLS, Ethernet, internet, broadband, and 4G/LTE.

● Powerful Performance

The appliance should have multi-core processor architecture and expansion modules for increased performance to run concurrent services, such as Lanner’s NCA-1515 with 2~16 Core Intel® Atom® C3000 Processor (Denverton), and 4x GbE RJ45 with Gen3 bypass ports, 2x SFP with LED ports, 2x GbE RJ45 ports (By SKU), in addition to SR-IOV and DPDK support.

● Wireless Connectivity

The platform must be designed for 5G Sub-6 and Wi-Fi 6 (802.11ax), providing active and backup connectivity for high reliability, enabling mission-critical applications to stay connected.

Solutions

Industry-leading SD-WAN solutions can assist financial institutions to control operational costs, increase security, and improve network efficiency to deliver an end-to-end premium customer experience and boost their banking business. The SD-WAN uCPE provides stable connectivity between multi-branch locations and headquarters and supports multiple networks, ensuring maximum uptime and network performance. In addition to facilitating priority to serve mission-critical applications on the network, minimizing downtime risks. SD-WAN can meet the needs of the financial sector with a robust network built on agility, scalability, security, and compliance.

Featuring 8, 12 or 16-core Intel® Xeon® D-2100 processors, 8x GbE RJ45, 4x SFP+ and Intel® QuickAssist Technology (by SKU) for improved network performance, the NCA-4025 delivers significant performance enhancement in running multiple virtual network functions VNFs in SD-WAN, reduces testing and validation efforts and accelerates time-to-market deployment.

The NCA-1515, a desktop network appliance powered by Intel® Atom® C3000 (codenamed Denverton) CPU, features robust performance and Intel’s QuickAssist Technology, offering cryptographic acceleration, multi-WAN architecture, and commercial-grade LAN functions in a small form factor.